formium.ru

Tools

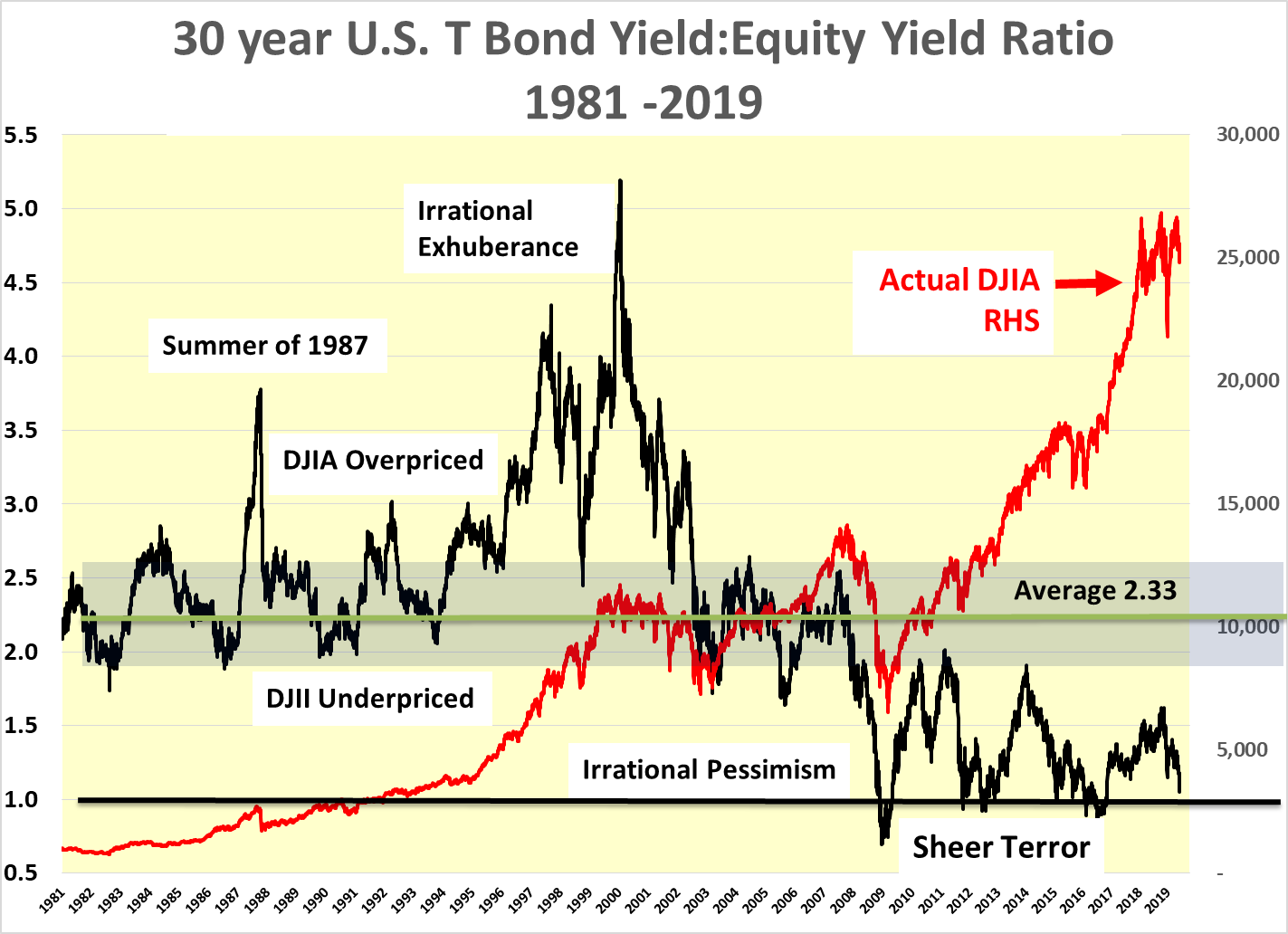

Djia

Get Dow Jones Industrial Average .DJI:Dow Jones Global Indexes) real-time stock quotes, news, price and financial information from CNBC. DJIA stands for the Dow Jones Industrial Average. View the full Dow Jones Industrial Average (DJIA) index overview including the latest stock market news, data and trading information. During these events, the Dow Jones Industrial Average (DJIA) dropped by an average of about 6%. In all but four cases, the market returned to positive. In the last 34 years, the Dow Jones Industrial Average index (in EUR) had a compound annual growth rate of %, a standard deviation of %, and a Sharpe. The DJIA Index includes 30 of the largest companies. The Dow Jones Industrial Average (The Dow), is a price-weighted measure of 30 US blue-chip companies. The index covers all industries except transportation and. Dow Jones 30 IndustrialIndex, DJIA. 41,++%. PM EDT 8/30/ Start Trading. Add to watchlist. Plus 82% of retail CFD accounts. The Global X Dow 30 Covered Call ETF (DJIA) seeks to provide investment results that correspond generally to the price and yield performance, before fees and. Get Dow Jones Industrial Average .DJI:Dow Jones Global Indexes) real-time stock quotes, news, price and financial information from CNBC. DJIA stands for the Dow Jones Industrial Average. View the full Dow Jones Industrial Average (DJIA) index overview including the latest stock market news, data and trading information. During these events, the Dow Jones Industrial Average (DJIA) dropped by an average of about 6%. In all but four cases, the market returned to positive. In the last 34 years, the Dow Jones Industrial Average index (in EUR) had a compound annual growth rate of %, a standard deviation of %, and a Sharpe. The DJIA Index includes 30 of the largest companies. The Dow Jones Industrial Average (The Dow), is a price-weighted measure of 30 US blue-chip companies. The index covers all industries except transportation and. Dow Jones 30 IndustrialIndex, DJIA. 41,++%. PM EDT 8/30/ Start Trading. Add to watchlist. Plus 82% of retail CFD accounts. The Global X Dow 30 Covered Call ETF (DJIA) seeks to provide investment results that correspond generally to the price and yield performance, before fees and.

Live Dow Jones data including quote, charts, news and analysis covering the Dow Jones Industrial Average (DJIA) in real time. The Dow Jones Industrial Average, which was one of the first stock indices and is one of the most commonly referred to barometers of equity performance in the. The DJIA Index includes 30 of the largest companies. Track the latest stock market news from the Dow Jones today. Plus, get ongoing analysis of the DJIA and Dow stocks, including Apple, Boeing and GE. Index performance for Dow Jones Industrial Average (INDU) including value, chart, profile & other market data. Dow Jones Industrial Average (the "DJIA"). The Trust's Portfolio consists of substantially all of the component common stocks that comprise the DJIA, which. The Dow Jones Industrial Average Reaches 1, Units for the First Time · On November 14, , the Dow Jones Industrial Average (DJIA) crossed the 1,point. Get the latest Dow Jones Industrial Average .DJI) value, historical performance, charts, and other financial information to help you make more informed. Find information for E-mini Dow Jones Industrial Average Index Overview provided by CME Group. View Overview. Track Dow Jones Industrial Index (DJIA) Stock Price, Quote, latest community messages, chart, news and other stock related information. Share your ideas and. The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow is a stock market index of 30 prominent companies listed on stock exchanges in the. Pre-market stock trading coverage from CNN. Get the latest updates on pre-market movers, S&P , Nasdaq Composite and Dow Jones Industrial Average futures. A Complete Dow Jones Industrial Average overview by Barron's. View stock market news, stock market data and trading information. Interactive chart of the Dow Jones Industrial Average (DJIA) stock market index for the last years. Historical data is inflation-adjusted using the. Dow Jones Industrial Average | historical charts for DJIA to see performance over time with comparisons to other stock exchanges. Discover historical prices for ^DJI stock on Yahoo Finance. View daily, weekly or monthly format back to when Dow Jones Industrial Average stock was issued. Dow Jones Industrial AverageSM (the “Index”); The Dow Jones Industrial AverageSM (DJIA) is composed of 30 “blue-chip” U.S. stocks; The DJIA is the oldest. Dow Jones Industrial Average Data delayed at least 15 minutes, as of Aug 30 BST. Register a free account to add this security to a watchlist. Graph and download economic data for Dow Jones Industrial Average (DJIA) from to about stock market, average, industry, and USA. DOW JONES INDUSTRIAL AVERAGE Dow Jones Dow Jones Dow Jones Industrial Industrial Industrial Date Average Date Average Date Average.

Fha Home Mortgage Rates Today

Check today's mortgage rates for buying or refinancing a home. Connect with us to estimate your personalized rate. The current mortgage rates stand at % for a year fixed mortgage and % for a year fixed mortgage as of August 28 pm EST. Check out current rates for a year FHA loan. These rates and APRs are current as of 08/28/ and may change at any time. They assume you have a FICO. For reference, the year fixed rate mortgage averaged % in July, according to Freddie Mac. So, my personal rate lock recommendations remain: LOCK if. Compare current mortgage interest rates and see if you qualify for a% interest rate discount. Contact a Mortgage Loan Officer today! The average interest rate is % for a year, fixed-rate mortgage in the United States, per mortgage technology and data company Optimal Blue. What is the interest rate for a credit score on an FHA loan? Current FHA loan rates for a borrower with a credit score are around %. Rates change. Personalize your rate ; 15 Year Fixed. $3, · % ; 20 Year Fixed. $2, · % ; 30 Year Fixed. $2, · %. FHA refinance rates today. Rates on FHA loans have moved around a lot in recent years — from less than 3 percent during the pandemic to 8 percent in October. Check today's mortgage rates for buying or refinancing a home. Connect with us to estimate your personalized rate. The current mortgage rates stand at % for a year fixed mortgage and % for a year fixed mortgage as of August 28 pm EST. Check out current rates for a year FHA loan. These rates and APRs are current as of 08/28/ and may change at any time. They assume you have a FICO. For reference, the year fixed rate mortgage averaged % in July, according to Freddie Mac. So, my personal rate lock recommendations remain: LOCK if. Compare current mortgage interest rates and see if you qualify for a% interest rate discount. Contact a Mortgage Loan Officer today! The average interest rate is % for a year, fixed-rate mortgage in the United States, per mortgage technology and data company Optimal Blue. What is the interest rate for a credit score on an FHA loan? Current FHA loan rates for a borrower with a credit score are around %. Rates change. Personalize your rate ; 15 Year Fixed. $3, · % ; 20 Year Fixed. $2, · % ; 30 Year Fixed. $2, · %. FHA refinance rates today. Rates on FHA loans have moved around a lot in recent years — from less than 3 percent during the pandemic to 8 percent in October.

Today's competitive mortgage rates ; Rate · % · % ; APR · % · % ; Points · · ; Monthly payment · $1, · $1, The year fixed rate mortgage had an average price of %. The average FHA (b) loan was a tenth of a percent higher, at %. Unfortunately, you can't go back in time to score a better mortgage rate. All you can do to find the best deal is compare today's current mortgage rates. Mortgage Interest Rates ; Refinance Program ; Government Loans (FHA, VA, USDA-RD) Year Fixed Rate Loans ; Refinance Program, % ; Conventional Year Fixed. Today's Rate on a FHA Year Fixed Mortgage Is % and APR % With an FHA year fixed mortgage, you can purchase a home with a lower down payment and. As of Aug. 28, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. Year Fixed Rate ; Rate: % ; APR: % ; Points ; Estimated Monthly Payment: $1, Today's Interest Rates ; CalHFA FHA · % ; CalPLUS FHA with 2% Zero Interest Program · % ; CalPLUS FHA with 3% Zero Interest Program · N/A ; CalHFA VA · %. New home purchase ; Construction loan · % · % ; year FHA · % · %. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Average Mortgage Rates, Daily ; 20 Year Fixed. %. % ; 15 Year Fixed. %. % ; 10 Year Fixed. %. % ; 30 Year Refinance. %. %. year FHA Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of Point(s) ($5,) paid at closing. On a. Jumbo LoansCollapse Opens DialogCollapse · Year Fixed-Rate Jumbo · Interest% · APR%. See how FHA mortgage rates compare ; year fixed FHA ; year fixed FHA, %, %. In March , the government reduced the cost of monthly MIP payments by 30 basis points for all FHA borrowers who took out loans after March 20, The current FHA loan rate for a year fixed FHA purchase loan is %, based on an average of over FHA loan lenders, banks and credit unions. For. Today's current FHA loan mortgage rates. See your personalized rates for a FHA mortgage by providing answers to a few questions below. Units: Percent, Not Seasonally Adjusted. Frequency: Daily. Notes: This index includes rate locks from Federal Housing Authority loans. FHA loans ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. %. %. $2, Today's competitive mortgage rates ; Rate % ; APR % ; Points ; Monthly Payment $1,

Wash Rules For Stocks

A wash sale is the sale of securities at a loss and the acquisition of same (substantially identical) securities within 30 days of sale date (before or after). The wash sale rule applies to any loss realized on the closing of a short sale of stock or securities if, within 30 days before or after the date of closing. Keep in mind that the wash sale rule goes into effect 30 days before and after the sale, so you have a day window to avoid buying the same stock. Because of the wash sale rule, the $ loss is disallowed and added to the cost basis of the repurchased shares. When you sell the repurchased shares any. A wash sale occurs when an investor purchases a security 30 days before or 30 days after selling an identical or similar security. The IRS instituted the wash. Wash sales and similar trading patterns are not themselves prohibited; the rules only deal with the tax treatment of capital losses and the accounting of the. The wash sale rule prohibits an investor from taking a tax deduction if they sell an investment at a loss and repurchase the same investment, or a substantially. Bonds issued by one institution, but with different maturity dates and different interest rates; Common stock and preferred stock of the same company; Stocks of. A wash sale is when an investor sells a security in their portfolio and, within 30 days, buys a new or substantially identical version of the same stock. This. A wash sale is the sale of securities at a loss and the acquisition of same (substantially identical) securities within 30 days of sale date (before or after). The wash sale rule applies to any loss realized on the closing of a short sale of stock or securities if, within 30 days before or after the date of closing. Keep in mind that the wash sale rule goes into effect 30 days before and after the sale, so you have a day window to avoid buying the same stock. Because of the wash sale rule, the $ loss is disallowed and added to the cost basis of the repurchased shares. When you sell the repurchased shares any. A wash sale occurs when an investor purchases a security 30 days before or 30 days after selling an identical or similar security. The IRS instituted the wash. Wash sales and similar trading patterns are not themselves prohibited; the rules only deal with the tax treatment of capital losses and the accounting of the. The wash sale rule prohibits an investor from taking a tax deduction if they sell an investment at a loss and repurchase the same investment, or a substantially. Bonds issued by one institution, but with different maturity dates and different interest rates; Common stock and preferred stock of the same company; Stocks of. A wash sale is when an investor sells a security in their portfolio and, within 30 days, buys a new or substantially identical version of the same stock. This.

Brokers also will have different rules on what is or is not a wash sale. For example, closing an AAPL stock trade for a loss, then opening a. A wash sale occurs when you sell or trade securities at a loss and within 30 days before or after the sale you: Buy substantially identical securities. The wash sale rule would clearly apply if you file your tax return jointly. And the IRS has issued guidance that says the wash sale rule applies even if you and. In short, a wash sale is when you sell a security at a loss for the tax benefits but then turn around and buy the same or a similar security. It doesn't even. The wash sale rule prohibits taxpayers from claiming a loss on the sale or other disposition of a stock or securities if, within the day period that begins. The wash-sale rule keeps investors from selling at a loss, buying the same (or "substantially identical") investment back within a day window, and claiming. To ensure that investors don't get a tax break and then instantly buy back their original investment, the government has what's known as the “wash sale” rule. A wash sale occurs when you sell a stock for a loss and then buy it again in the 61 day period 30 days before and 30 days after the sale. You. A wash sale is categorized when an investor sells a stock or security and repurchases the same or a substantially identical security within 30 days of the sale. If you replace the investment shortly after the sale — or shortly before the sale — this rule can prevent you from deducting your loss. General Rule. Capital. Generally, a wash sale is what occurs when you sell securities at a loss and buy the same shares within 30 days before or after the sale date. The IRS wash-sale rule explicitly prohibits investors from deducting their losses from wash sales. The purpose of this rule is to prevent investors from abusing. What is the wash sale rule? When you sell a security at a loss and buy a substantially identical security within 30 days before or after the day of sale, the. Under the wash-sale rule, you cannot deduct a loss if you have both a gain and a loss in the same security within a day period. (That's calendar days, not. The wash sale rule prevents investors from claiming the tax benefits from stock losses if they have also purchased the same stock any time during a window. Acquire a contract or option to buy substantially identical securities. Internal Revenue Service rules prohibit you from deducting losses related to wash sales. What Is the Wash Sale Rule? A wash sale occurs when investors buy a security that is substantially identical to one they sold or traded at a loss 30 days. The wash sale rule prevents you from deducting losses when you buy replacement stocks or securities (including contracts or options) within a day period. A wash sale is the sale of securities at a loss and the acquisition of same (substantially identical) securities within 30 days of sale date (before or after). Understanding the wash-sale rule can help you save on taxes. If you sell a stock for tax-loss harvesting purposes, you can't rebuy the same or similar stock.

Average Interest On Home Equity Loan

Low interest rate. Borrowing against your assets, such as your home equity, may provide you with a lower interest rate. Cover large expenses. You can use the. Home Lending: To receive relationship benefits on a new KeyBank mortgage loan, which provides a % interest rate reduction, you must have owned a. Home equity loan interest rates. Fixed rate. As low as. % APR · $ Home equity loan interest rates. Fixed rate. As low as. % APR. How do I apply for a Home Equity Loan or Line of Credit (HELOC)?. Please Members who choose to proceed with an Interest-Only HELOC may experience. $ Origination Fee. An owner-occupied Home Equity Loan APR (Annual Percentage Rate) is determined based upon the specific terms of the loan and credit history. As of March 11, , the national average interest rate on a home equity loan is %, according to data from Bankrate. However, keep in mind that the rate. Average overall rate: % ; year fixed home equity loan: % ; year fixed home equity loan: %. Rates vary from % APR to % APR depending on property state, loan amount and other variables. Please consult a banker for pricing in your region. Credit score rate estimates are national averages based on a year fixed-rate loan of $, A mortgage annual percentage rate (APR) includes the yearly. Low interest rate. Borrowing against your assets, such as your home equity, may provide you with a lower interest rate. Cover large expenses. You can use the. Home Lending: To receive relationship benefits on a new KeyBank mortgage loan, which provides a % interest rate reduction, you must have owned a. Home equity loan interest rates. Fixed rate. As low as. % APR · $ Home equity loan interest rates. Fixed rate. As low as. % APR. How do I apply for a Home Equity Loan or Line of Credit (HELOC)?. Please Members who choose to proceed with an Interest-Only HELOC may experience. $ Origination Fee. An owner-occupied Home Equity Loan APR (Annual Percentage Rate) is determined based upon the specific terms of the loan and credit history. As of March 11, , the national average interest rate on a home equity loan is %, according to data from Bankrate. However, keep in mind that the rate. Average overall rate: % ; year fixed home equity loan: % ; year fixed home equity loan: %. Rates vary from % APR to % APR depending on property state, loan amount and other variables. Please consult a banker for pricing in your region. Credit score rate estimates are national averages based on a year fixed-rate loan of $, A mortgage annual percentage rate (APR) includes the yearly.

The maximum LTV for condominiums is 75%. Payment example: For a $10, Home Equity Loan for a term of 5 years @ % interest rate, the monthly payment will. The minimum interest rate is % with an APR of %. Rates are for owner-occupied properties only. Maximum loan-to-value (LTV) is 80%. Processing fee of. %. APR · Fixed Rate Advance · Choosing a HELOC from BECU · Features & Benefits · Uses of a HELOC · How HELOCs Work · Fixed Interest-Rate Advance · Frequently. Home Equity Loan Rates ; $25, - $49,, %, %, % ; $50, - $74,, %, %, % ; $75, - $,, %, %, %. What are today's average interest rates for home equity loans? ; Home equity loan, %, % – % ; year fixed home equity loan, %, % – % ; HELOC intro rates as low as % APR for 6-months!* Regular HELOC rates starting at % APR A Home Equity Line of Credit (HELOC), sometimes referred to as. HELOCs typically have a variable interest rate (one that changes) versus fixed rates, which are typical in a home equity loan. Home Equity Loan. Home equity. It'll be an additional loan called a heloc at the current market rate. Google says the average heloc is % today. Interest Only Home Equity Line-of-Credit ; Intro Rate, % · % ; Overall Limitation, 90% of appraised value, less balance of 1st mortgage, 90% of appraised. Bank, APR, Line Amount, Description ; PenFed Credit Union, %, $25,,, Interest-only HELOC option (for members) ; Bank of America, Varies. As of Aug. 26, the average rate on a home equity loan overall was %, unchanged from the previous week's rate. The average rate on year fixed home equity. *. APR=Annual Percentage Rate · 1. Home Equity Loan: APR as low as %. · 2. Home Equity Line of Credit: APR will be variable based on an index plus or minus a. property value estimate to get your current equity percentage in your home. Average Home Equity Interest Rates. Loan Type, Average Rate, Range. year fixed. Some lenders will offer a discount on a home equity loan's interest rate if you have another account with the bank. average credit (). I have. Because a Home Equity Loan is a second mortgage, there will be similar fees, usually % of the loan amount. About Closing Costs. Debt. Less than. Tap into your home equity with low fixed rate loan options · Current Home Equity Loan Rates · Term Length Options: · Rate Range: · Year Fixed Rate · % - APR is determined by adding the prime rate plus a margin. The margin is based on credit history and term of loan. (Prime Rate is % as of August 1, ). Personal loan. Consolidate debtFootnote 1, pay for home improvements, or make a major purchase. Fixed interest rates. Home Equity Loans are fixed-rate loans. Rates are as low as % APR and are based on an evaluation of credit history, CLTV (combined loan-to-value) ratio. Home Equity Rates ; 12 Months, % ; 24 Months, % ; 36 Months, % ; 48 Months, %.

Questions To Ask Your Life Insurance Agent

Do I have enough coverage to replace all of my belongings? · Should I increase my coverage limits over time to cover updates that I make to my home? · Am I. #1 What is covered and what type of insurance policy do I have on my home? · #2 I'm remodeling or adding on to my home. · #3 I work from home. · #4 How can I save. 1. Do I Absolutely Need Life Insurance? · 2. What Type of Life Insurance Do I Need To Buy? · 3. Is There a Waiting Period Before Coverage Goes Into Effect? · 4. Do. Do I need flood insurance (Does my homeowners insurance cover flood)? Where it rains it can flood. · Do I need flood insurance if I rent? · Do I live in a high-. Would you be comfortable visiting people at their homes and discussing insurance policies? · Who are the parties involved in a life insurance contract? · What. Check if the agent has placed riders into the proposal. · For critical illness related insurance, check with the agent if there are any fine. 6 Questions You Must Ask Your Life Insurance Agent · Question 1 - How good is the insurance company? · Question 2 - What are the guarantees under the policy? Essential Questions to Ask Your Life Insurance Agents · 1. How Many Types of Life Insurance Policies Does the Insurer Cater? · 2. What Are the Guaranteed and. I've got my insurance. · Find insurance information and coverage · What if I get in a vehicle accident? · Can I bundle my policies and receive a discount? · How can. Do I have enough coverage to replace all of my belongings? · Should I increase my coverage limits over time to cover updates that I make to my home? · Am I. #1 What is covered and what type of insurance policy do I have on my home? · #2 I'm remodeling or adding on to my home. · #3 I work from home. · #4 How can I save. 1. Do I Absolutely Need Life Insurance? · 2. What Type of Life Insurance Do I Need To Buy? · 3. Is There a Waiting Period Before Coverage Goes Into Effect? · 4. Do. Do I need flood insurance (Does my homeowners insurance cover flood)? Where it rains it can flood. · Do I need flood insurance if I rent? · Do I live in a high-. Would you be comfortable visiting people at their homes and discussing insurance policies? · Who are the parties involved in a life insurance contract? · What. Check if the agent has placed riders into the proposal. · For critical illness related insurance, check with the agent if there are any fine. 6 Questions You Must Ask Your Life Insurance Agent · Question 1 - How good is the insurance company? · Question 2 - What are the guarantees under the policy? Essential Questions to Ask Your Life Insurance Agents · 1. How Many Types of Life Insurance Policies Does the Insurer Cater? · 2. What Are the Guaranteed and. I've got my insurance. · Find insurance information and coverage · What if I get in a vehicle accident? · Can I bundle my policies and receive a discount? · How can.

Why did you choose this plan for my business? Insurance policies can be confusing when you don't deal with them every day. That's where your agent can help. In. What experience do you have in the industry? 2. Who do you work with currently? 3. What agencies do you work with? 4. What type of clients are. Questions to Ask An Insurance Agent Before Buying · 2. Have you handled clients that fit my profile? · 3. What happens if? · general-insurance-questions-to-ask · 4. Good Questions to Ask the Interviewer. "Can you explain the typical client profile that your agency serves, and how do you tailor your insurance products to. What date does your coverage come into effect? · Do you know what is not covered by your policy? · Is the policy you are about to purchase, replacing a different. Do I need flood insurance (Does my homeowners insurance cover flood)? Where it rains it can flood. · Do I need flood insurance if I rent? · Do I live in a high-. What should I expect during the insurance adviser process? · What is your Insurance Adviser's experience? · What type of insurance do I need? · What benefits will. Do I need life insurance if I already get it through work? · How much does life insurance cost? · What types of life insurance can I choose from? · How are death. 1 - How much coverage did you quote on my house? · 2- How much coverage is provided for my personal property (my stuff)? · 3- Are my contents insured for. The questions you should ask yourself is; what are my assets, do I own a home, how expensive is the car you're driving? Do you own your car. 7 Questions to Ask Your Life Insurance Agent · 1. Is the insurance company credible? · 2. What type of policy are you buying? · 3. What are the benefits of the. Key Questions to Ask About Life Insurance · What Type of Life Insurance Should You Choose? · How Much Coverage Do You Need? · What Does the Policy Exclude? “What other life insurance you have in place to pay for X?” This is a must-ask life insurance questions to ask clients. The reason you ask this is twofold. Helping Blue-Collar Businesses Find Tailored · What industries do you specialize in? · What is your personal experience working with businesses. 1. Why Do I Want Life Insurance? · 2. What Type of Coverage Is Available? · 3. What If I Don't Die? · 4. How Can I Upgrade My Current Policy? · 5. Where Do I Buy a. 9. Is my agent accessible after regular business hours? Life happens outside of business hours. Does your agency have some means of accessibility during non-. 10 Crucial Questions to Ask Before Joining any Insurance Agency Group · 1: Is there an upfront charge, and if so, what does this cover? · 2: Are there monthly. Hopefully they are getting advice from the advisor for the product they bought. With life insurance the costs are actually buying you a product. A tax free. What are some questions that I should ask a financial advisor/insurance agent when I meet with them · Cost of premiums per month · How extensive/. Q: What are the details of my insurance warranty?

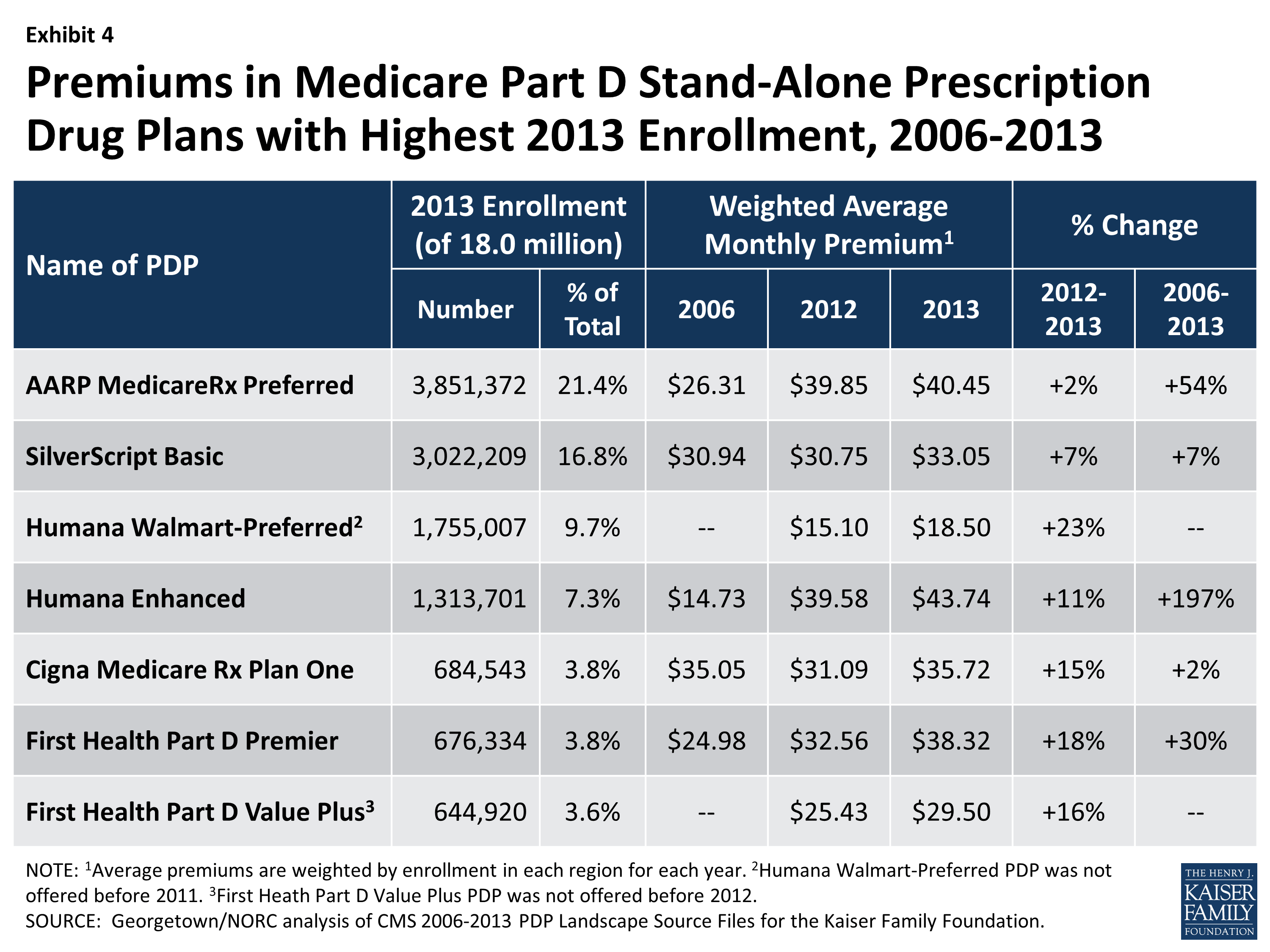

Cheapest Plan D Medicare

Once you reach the coverage gap, you'll pay no more than 25% of the cost for your plan's covered brand-name prescription drugs. You'll pay this discounted rate. Farm Bureau Health Plans offers two affordable Medicare Part D plans that are available in every county in Tennessee: Farm Bureau Essential Rx and Farm Bureau. Explore your Medicare coverage options · Get a summary of your current coverage · Use your saved drugs & pharmacies to compare plan costs. Understand the Medicare Part D prescription drug coverage that comes with your HealthPartners plan through formularies (drug lists), answers to. In addition to Medicare Supplement Insurance, you will need Part D Drug Coverage. Standard Medicare Supplement Coverage. To make it easier for you to compare. It is important to ensure the plan you have still covers your prescriptions and at the best prices. If you lose "creditable drug coverage" under certain. You'll pay $35 (or less) for a one-month supply of each Part D-covered insulin product, even if you get Extra Help to lower your prescription drug costs. Pharmacy networks can offer prescription drugs at reduced rates to save you money. This is because they contract with your Medicare prescription drug plan. If. Best Overall and Best for Low Costs: Aetna · Offers the best value of all PDP providers when considering premiums and deductibles · Offers free prescription. Once you reach the coverage gap, you'll pay no more than 25% of the cost for your plan's covered brand-name prescription drugs. You'll pay this discounted rate. Farm Bureau Health Plans offers two affordable Medicare Part D plans that are available in every county in Tennessee: Farm Bureau Essential Rx and Farm Bureau. Explore your Medicare coverage options · Get a summary of your current coverage · Use your saved drugs & pharmacies to compare plan costs. Understand the Medicare Part D prescription drug coverage that comes with your HealthPartners plan through formularies (drug lists), answers to. In addition to Medicare Supplement Insurance, you will need Part D Drug Coverage. Standard Medicare Supplement Coverage. To make it easier for you to compare. It is important to ensure the plan you have still covers your prescriptions and at the best prices. If you lose "creditable drug coverage" under certain. You'll pay $35 (or less) for a one-month supply of each Part D-covered insulin product, even if you get Extra Help to lower your prescription drug costs. Pharmacy networks can offer prescription drugs at reduced rates to save you money. This is because they contract with your Medicare prescription drug plan. If. Best Overall and Best for Low Costs: Aetna · Offers the best value of all PDP providers when considering premiums and deductibles · Offers free prescription.

Best Insurance Companies for Medicare Part D Prescription Drug Plans ; VERMONT · Wellcare ; WASHINGTON · Asuris Northwest Health ; WASHINGTON · Wellcare ; WEST. By design, Original Medicare doesn't provide prescription drug coverage. If you need prescription drugs, you can purchase a Medicare Part D prescription. October 15 - December 7. Part D and Medicare Annual Open Enrollment Period. This is the time to enroll in or switch plans. Your selection or plan will take. Data as of November 05, Includes CY approved plans. Employer sponsored plans ( series) are excluded. Plans under sanction are not shown. Find Medicare Part D plans available in your area. Learn more about Humana prescription drug coverage to help cover medication costs. plan more affordable while maintaining high-quality benefits and coverage. The transition to a Medicare Part D prescription drug plan was an option that. Drug co-payments are as low as $ for brand or $ for generic drugs in when enrolled in a Part D drug plan. How does EPIC help members apply for. We compiled a list of the top 5 best Medicare Part D plans for Policies vary by county, so moving may warrant a plan change. All of the Part D plans are private insurance plans. Most participants will pay a monthly premium, but that premium buys you the peace of mind of knowing that. #1) Stand-alone Prescription Drug Plans (PDP) A stand-alone drug plan is typically chosen to go along with a Medicare Supplement plan (which aren't able to. National base premium is $ People with high incomes have a higher Part D premium. Annual deductible, Varies by plan. Cannot be more than $ if you do. How much does Original Medicare Part B cost? · Most Medicare members must pay a monthly premium of $ · If you don't enroll in Medicare Part B as soon. What you'll pay under Extra Help in · Plan premium: $0 · Plan deductible: $0 · Prescriptions you fill at one of your plan's participating pharmacies: Up to. A Medicare prescription drug plan can be a smart way to manage the cost of the medications you take now—and those you may need in the future. Tailor their benefits, provider network, and drug formularies to the needs of the specific group they serve. · Include. Medicare drug coverage (Part D). Drug. All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes. plan). Then, compare costs Drug coverage (Part D) · How to get prescription drug coverage; 6 tips for choosing Medicare drug coverage. Search. Search. Print. All yellow plans are referred to as "benchmark" plans. Page 1 of 3. Page 2. MEDICARE PART D STAND-ALONE PRESCRIPTION DRUG. 1. Consider switching to generics or other lower-cost drugs. · 2. Choose a Medicare drug plan that offers additional coverage during the gap. · 3. Pharmaceutical. Its costs and coverage vary based on your location and the plan you select. Many Medicare Advantage (Part C) plans also include Part D coverage and additional.

How To Save 10k Fast

10K Savings Challenge | Saving Challenge | 10K Challenge | Saving Challenge Printable | Money Saving Challenge | Editable Template | Canva How The 10K in Length of time, in years, that you plan to save. Step 4: Interest Rate. Estimated Interest Rate. Your estimated annual interest rate. Step 5: Compound It. Saving/Investing $10, (USD) takes about 1 year when single in the United States if you work to earn the top of what is called a living wage . The first step toward saving money is budgeting—if you don't know where your money is going, you can't begin to save it. We recommend keeping track of every. How I Saved $10, in Six Months · 1. Set goals & practice visualization. · 2. Have an abundance mindset. · 3. Stop lying to yourself & making excuses. · 4. Cut. The higher your rate of return, the faster your money will grow. Both of these factors can have a significant impact on your savings plan and the amount you. The fastest way to reach your savings goals is to couple reducing expenses with earning more money. You'll be able to save quickly if you can greatly reduce or. Saving Money on Groceries · Write down everything you need for the week. The less times you go shopping, the less likely you'll be to pick up something you don't. Tips for Reaching Your Savings Goal Faster · Automate your savings: Set up a regular auto-deposit from your bank account into a savings account with automatic. 10K Savings Challenge | Saving Challenge | 10K Challenge | Saving Challenge Printable | Money Saving Challenge | Editable Template | Canva How The 10K in Length of time, in years, that you plan to save. Step 4: Interest Rate. Estimated Interest Rate. Your estimated annual interest rate. Step 5: Compound It. Saving/Investing $10, (USD) takes about 1 year when single in the United States if you work to earn the top of what is called a living wage . The first step toward saving money is budgeting—if you don't know where your money is going, you can't begin to save it. We recommend keeping track of every. How I Saved $10, in Six Months · 1. Set goals & practice visualization. · 2. Have an abundance mindset. · 3. Stop lying to yourself & making excuses. · 4. Cut. The higher your rate of return, the faster your money will grow. Both of these factors can have a significant impact on your savings plan and the amount you. The fastest way to reach your savings goals is to couple reducing expenses with earning more money. You'll be able to save quickly if you can greatly reduce or. Saving Money on Groceries · Write down everything you need for the week. The less times you go shopping, the less likely you'll be to pick up something you don't. Tips for Reaching Your Savings Goal Faster · Automate your savings: Set up a regular auto-deposit from your bank account into a savings account with automatic.

The higher your rate of return, the faster your money will grow. Both of these factors can have a significant impact on your savings plan and the amount you. Saving $ per month will mean that you reach your $10, target in just 2 years and 1 month. These figures assume no interest is being accumulated on your. How much should you save towards your child's tuition? Get a quick estimate of approximately how much you'll need to save using our calculator tool. Get a job, save up every penny and don't spend. I just turned 20 and I have a tad less than 40k saved up! Try to limit spending on food. How To Save $10, in a Year or Less · 1. Review Your Finances · 2. Build a Budget · 3. Cut Back Spending on Nonessentials · 4. Save Money on Essential Expenses · 5. 8 ways to save money quickly · 1. Change bank accounts. · 2. Be strategic with your eating habits. · 3. Change up your insurance. · 4. Ask for a raise—or start job. Amazon prime logo. Unlock fast, free delivery on millions of Prime eligible items. Save Box 10k, Caja De Ahorros , Tenkaybox for Saving Money. Add to. Determining how much to save is followed quickly by figuring out just where to put it. Your best bet is in an online high-yield savings account, which pays. Arrived fast. Easy to read and down. Michele May 28, 5 out of 5 stars 10K Budget Savings Challenges, Save a Year, 10k Savings Challenge Budget. Saving for retirement might be the most important thing you ever do with your money. And the earlier you begin, the less money it will take! 4 minute read. Work out how long it'll take to save for something, if you know how much you can save regularly. Or if you need something by a certain date, we can tell you how. Write your ideal savings goal target and deadline. Divide by the number of months remaining to see how much you should save. Want to pay cash for a $10, car. Up next in Saving · Compound interest. The power of compounding grows your savings faster · Save for an emergency fund. Be prepared for life's surprises · Simple. Saving a bit more each week will help you reach your goal faster. $ per week after weeks will give you. $5, Saving a bit more each week will. Arrived fast. Easy to read and down. Michele May 28, 5 out of 5 stars 10K Budget Savings Challenges, Save a Year, 10k Savings Challenge Budget. With a number in mind for your down payment, you can create a car-savings fund to help you manage the money you save. To save money and get closer to your goal. Saving a little each day can go a long way. Enter the amount you can save each day along with an expected rate of return to see how quickly your savings can. Either way, a savings account calculator can help you quickly work out: How much you'll need to put aside each month to meet your goal. How long it could. Saving a bit more each week will help you reach your goal faster. $ per week after weeks will give you. $5, Saving a bit more each week will. Saving $ per month will mean that you reach your $10, target in just 2 years and 1 month. These figures assume no interest is being accumulated on your.

How To Get Collections Off Credit Report Without Paying

You can try to negotiate with the collection agency to have the collection removed. You would pay a fee to the collection agency and they would stop reporting. Monitor your credit report. · Identify and dispute any strange collection account on the report. · When the credit bureau fails to remove the negative mark from. You can try to negotiate with the collection agency to have the collection removed. You would pay a fee to the collection agency and they would stop reporting. To get an incorrect late payment removed from your credit report, you need to file a dispute with the credit bureau that issued the report containing the error. You will have to call the collections agency directly, not your apartment, and ask for a "pay for delete". Ask that since the debt will be. Even if your debt is several years old and the deadline for filing a lawsuit to collect it has expired, your debt still may be reported to the credit reporting. Ask the collector to tell the bureaus to remove any negative information about the debt from your credit files. How to get collections off credit report without paying? There are 2 main ways to get collections off your credit report without paying for deletion. After. Pay off the debt. Some collectors will accept less than what you owe to settle a debt. Before you make any payment to settle a debt, get a signed letter. You can try to negotiate with the collection agency to have the collection removed. You would pay a fee to the collection agency and they would stop reporting. Monitor your credit report. · Identify and dispute any strange collection account on the report. · When the credit bureau fails to remove the negative mark from. You can try to negotiate with the collection agency to have the collection removed. You would pay a fee to the collection agency and they would stop reporting. To get an incorrect late payment removed from your credit report, you need to file a dispute with the credit bureau that issued the report containing the error. You will have to call the collections agency directly, not your apartment, and ask for a "pay for delete". Ask that since the debt will be. Even if your debt is several years old and the deadline for filing a lawsuit to collect it has expired, your debt still may be reported to the credit reporting. Ask the collector to tell the bureaus to remove any negative information about the debt from your credit files. How to get collections off credit report without paying? There are 2 main ways to get collections off your credit report without paying for deletion. After. Pay off the debt. Some collectors will accept less than what you owe to settle a debt. Before you make any payment to settle a debt, get a signed letter.

If you owe a debt, act quickly — preferably before it's sent to a collection agency. Contact your creditor, explain your situation and try to create a payment. If your goal is to get a charge-off removed and the debt has been sent to a collector, the only way to do it is to negotiate with your original creditor. That's. In exchange for full or partial payment, the collector agrees to remove a collection account from your credit report. In theory, that eliminates the credit. Although the debt collector is not required to accept a payment agreement, many collectors will try to make arrangements if you fully explain your situation. Option 2: Send a pay for delete letter A pay for delete letter is a way to negotiate with a collection agency to have negative information removed from your. File bankruptcy. You remove your debts without paying. You have to negotiate that BEFORE you pay it. Be sure to get it in writing before you. Pay for deletion in debt collection refers to an agreement between a debtor and a debt collector where the debtor agrees to pay off the debt in full in. When you use credit to make purchases or pay for With an unsecured credit agreement, you get credit without promising security to the creditor. Even if you're still in the debt collection process, you can try to negotiate a “pay-for-delete” agreement with a creditor or debt collector. This will remove a. Most lenders want a borrower to have a DTI below 43%. With exceptions, your lender may require you to pay off any collections and charge-offs on your credit. It is also possible to have a collection removed from your credit report before credit report in exchange for paying a reduced amount of the original debt. Information about debts may be removed from your credit report six years after they were incurred (or after the last payment was made), but removing debt. If a paid collection on your credit reports is accurate, you can still get it removed early. One method is to ask the current creditor —the original creditor. If a debt collector tries to convince you that payment will remove all derogatory notations associated with that account from your credit report, have them send. Paying off a collection could cause the score to increase, decrease or have no impact at all. It depends on the change in the information reported on the. In reality, a missed payment on your debt will only take six years to disappear from your credit report, but this has no effect on whether you still need to pay. The goal of a pay for delete arrangement is to get a collection agency to remove a collection account entirely from your credit report before the Fair Credit. Don't Make Decisions Based on Debt Collection Harassment. A debt collector's job is to convince you to pay its debts first. Instead, make your own decision. 3 ways to potentially get collection accounts removed from your credit report · 1. Send a pay for delete letter · 2. Request a goodwill deletion · 3. Dispute the. Pay for delete refers to the process of getting a debt collector to remove collection account removed from your credit report.

Jedi Etf

Check our interactive JEDI chart to view the latest changes in value and identify key financial events to make the best decisions. VanEck Space Innovators UCITS ETF - USD ETF technical analysis with dynamic chart and Delayed Quote | Swiss Exchange: JEDI | Swiss Exchange. JEDI Price - See what it cost to invest in the VanEck Space Innovators ETF A USD Acc fund and uncover hidden expenses to decide if this is the best. Choosing the right Jedi ETF for long-term cryptocurrency investment requires careful consideration. It's essential to assess the ETF's underlying assets. Invest in Vaneck Space Innovators, Deutsche Börse Xetra: JEDI ETF - View real-time JEDI price charts. Online commission-free investing in Vaneck Space. Discover JEDI stock price history and comprehensive historical data for the VanEck Space Innovators UCITS A USD Acc ETF, including closing prices. Find the latest VanEck Space Innovators UCITS ETF A USD Acc (JEDI.L) stock quote, history, news and other vital information to help you with your stock. ETF. VanEck Space Innovators UCITS ETF (formium.ru). XETRA Deutsche Börse. EUR. IEYU9K6K2. Save. 27 June – 20 August Compare with. Select a tab. JPMorgan Equity Premium Income ETF seeks to deliver monthly distributable income and equity market exposure with less volatility. EXPERTISE. Portfolio. Check our interactive JEDI chart to view the latest changes in value and identify key financial events to make the best decisions. VanEck Space Innovators UCITS ETF - USD ETF technical analysis with dynamic chart and Delayed Quote | Swiss Exchange: JEDI | Swiss Exchange. JEDI Price - See what it cost to invest in the VanEck Space Innovators ETF A USD Acc fund and uncover hidden expenses to decide if this is the best. Choosing the right Jedi ETF for long-term cryptocurrency investment requires careful consideration. It's essential to assess the ETF's underlying assets. Invest in Vaneck Space Innovators, Deutsche Börse Xetra: JEDI ETF - View real-time JEDI price charts. Online commission-free investing in Vaneck Space. Discover JEDI stock price history and comprehensive historical data for the VanEck Space Innovators UCITS A USD Acc ETF, including closing prices. Find the latest VanEck Space Innovators UCITS ETF A USD Acc (JEDI.L) stock quote, history, news and other vital information to help you with your stock. ETF. VanEck Space Innovators UCITS ETF (formium.ru). XETRA Deutsche Börse. EUR. IEYU9K6K2. Save. 27 June – 20 August Compare with. Select a tab. JPMorgan Equity Premium Income ETF seeks to deliver monthly distributable income and equity market exposure with less volatility. EXPERTISE. Portfolio.

Analyze VANECK SPACE UCITS ETF (JEDI): check AUM and research returns, dividends, fund flows, and other key stats. Get VanEck Space Innovators UCITS ETF A USD Acc (JEDI-DE:XETRA) real-time stock quotes, news, price and financial information from CNBC. ETF. Class, Class 2 Equity Index ETF. Alphanumeric Code, JEDI. Isin Code, IEYU9K6K2. Lot Size, Total Annual Fees, %. Currency Denomination, USD. After all, investors can build a diversified portfolio of ETFs for less than percent per year. But an all-in-one ETF might still be a better choice for. Latest VanEck Space Innovators UCITS ETF A USD Acc (JEDI:LSE:USD) share price with interactive charts, historical prices, comparative analysis, forecasts. JEDI. VanEck Space Innovators UCITS ETF - USD. +%. BIGT. L&G Pharma Breakthrough UCITS ETF - USD. +%. TRET. VanEck Global Real Estate UCITS ETF - EUR. An easy way to get VanEck Space Innovators UCITS ETF Accum A USD real-time prices. View live JEDI stock fund chart, financials, and market news. JEPI | A complete JPMorgan Equity Premium Income ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF. ISIN: IEYU9K6K2 | WKN: A3DP9J | Symbol: JEDI | Type: ETF. ▻. Overview Charts Price History. Xetra Frankfurt. Xetra real-time. Watchlist Portfolio. Justice, Equity, Diversity & Inclusion (JEDI) · Engage · Our Associates · Supporting the Financial Advisor · Events · Careers · Contact. Advantage/ETF Advantage. The JEDI Exchange Traded Fund (ETF) is provided by VanEck. It is built to track an index: MVIS Global Space Industry ESG Index. The JEDI ETF provides. Explore JEPI for FREE on ETF Database: Price, Holdings, Charts, Technicals, Fact Sheet, News, and more. Performance charts for Vaneck Space Innovators UCITS ETF (JEDI - Type ETF) including intraday, historical and comparison charts, technical analysis and. Complete VanEck Space Innovators UCITS ETF funds overview by Barron's. View the JEDI funds market news. JEDI | A complete VanEck Space Innovators UCITS ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF. VanEck Space Innovators UCITS ETF Accum A USD (JEDI) - stock quote, history, news and other vital information to help you with your stock trading and. Vaneck Space Innovators UCITS ETF (JEDI@EBS). Contract Information Exchange-Traded Fund (ETF). Margin Requirements. Initial Margin, Default. Maintenance. Get VanEck Space Innovators UCITS ETF A USD Acc (JEDI-GB:London Stock Exchange) real-time stock quotes, news, price and financial information from CNBC. JEDI ETF · ETF Screener. Open side navigation menuOpen search bar. Home · World · US Trackinsight will soon implement its new rating system introducing. JEDIUSTR Index. Base Date, 02/05/ Inception Date, 06/01/ Number of Components, 1. Eligible Universe, SPDR S&P ETF Trust (SPY). Rebalancing.

Ally Bank Ranking

The Weiss safety rating of Ally Bank (Sandy, UT) is B. Members Invested. Ally Financial. Top Affiliates: GMAC Mortgage · Ally Bank An organization ranking 50 of 3, means that only 3, of the tens of. 20 Biggest Banks in America · Ally Bank · KeyBank · American Express National Bank · Huntington National Bank · Morgan Stanley Private Bank · Ally has an award-winning online bank (member FDIC), one of the largest full service auto finance operations in the country, a complementary auto-focused. JPMorgan Chase & Co's brand is ranked #72 in the list of Global Top Brands, as rated by customers of JPMorgan Chase & Co. Their current market cap is. Ally Financial from Detroit (MI), US is ranked in the Top World Banks by Tier 1 ranking, falling place(s) on the previous ranking. This ranking is. Ally is one of the largest car finance companies in the US, providing car financing and leasing for million customers and originating million car loans. The following table lists the largest bank holding companies in the United States ranked by total assets of March 31, per the Federal Financial. The five largest banks in America are JPMorgan Chase, Bank of America, Wells Fargo, Citibank and U.S. Bank. · Those five banks have combined assets of more than. The Weiss safety rating of Ally Bank (Sandy, UT) is B. Members Invested. Ally Financial. Top Affiliates: GMAC Mortgage · Ally Bank An organization ranking 50 of 3, means that only 3, of the tens of. 20 Biggest Banks in America · Ally Bank · KeyBank · American Express National Bank · Huntington National Bank · Morgan Stanley Private Bank · Ally has an award-winning online bank (member FDIC), one of the largest full service auto finance operations in the country, a complementary auto-focused. JPMorgan Chase & Co's brand is ranked #72 in the list of Global Top Brands, as rated by customers of JPMorgan Chase & Co. Their current market cap is. Ally Financial from Detroit (MI), US is ranked in the Top World Banks by Tier 1 ranking, falling place(s) on the previous ranking. This ranking is. Ally is one of the largest car finance companies in the US, providing car financing and leasing for million customers and originating million car loans. The following table lists the largest bank holding companies in the United States ranked by total assets of March 31, per the Federal Financial. The five largest banks in America are JPMorgan Chase, Bank of America, Wells Fargo, Citibank and U.S. Bank. · Those five banks have combined assets of more than.

Ally ranked number 71 on Fortune's Best Companies To Work For. formium.ru · Go Back.

Ally Financial is a bank holding company that provides financial services including car finance, online banking via a direct bank, corporate lending. Ally Financial, which is ranked on the Fortune , a list of America's largest companies. The top companies on the Fortune -- Fortune. There is no minimum deposit required to open an account. Ally Bank is a good option for people who are looking to save money and earn a high interest rate. The. Ally is solid, they're relatively big and well established which is reassuring but that also means they can afford to lag the market on rates. It is on the list of largest banks in the United States by assets and has million depositors. The company has sold more than 5 million vehicles. Ally Bank is an internet bank in the U.S. with over $90 billion in deposits. Ally Bank's accounts have no minimum balance requirement and monthly service. This organization is not BBB accredited. Bank in Ft Washington, PA. See BBB rating, reviews, complaints, & more. Ally Bank has ranked as a top bank in three separate categories in GOBankingRates' Picks for the Best Banks of (January). Media Relations. Send your. 1 in Digital Banking Apps Provider Ranking. April 20, | Digital Banking Ally Bank's personal lending division, Ally Lending, has brought its. Ally Bank. Ally Bank. Forbes Advisor. Our ratings take into account a We ranked SoFi highly because its combined checking and savings account. Ally Bank is the 14th most popular consumer bank and the th most popular brand View full Consumer Banks ranking · Send your own survey to customers of. In order to ensure that you have the most recent rating for a bank or thrift, you can use the links at the bottom of this page to go to the website of the. Members Invested. Ally Financial. Top Affiliates: GMAC Mortgage · Ally Bank An organization ranking 50 of 3, means that only 3, of the tens of. WeBank of China, Ally Bank in the US, and the retail arm of ING Group, topped The Asian Banker's the inaugural global ranking of leading digital banks. For example, the bank's CDs offer APYs as high as %, though they can reach as low as %, depending on the length of the term. Ally's Online Savings. Ally has an award-winning online bank (member FDIC), one of the largest full service auto finance operations in the country, a complementary auto-focused. Ally ranked first among banks surveyed by GOBankingRates in two important categories: service via live chat with a person and 24/7 phone customer service. Find the Best Banks In the U.S. including Alliant Credit Union, Ally Bank COMPLETE RANKINGS; REGIONAL RANKINGS; Money's Methodology. MORE FROM MONEY. Making your financial life simple and secure has always been our thing. Easily manage your bank, credit card, invest, auto and home loan accounts on the go. If you max your balance to $2,, that's $ in interest earnings in a year — which is why we ranked Ally Bank Spending Account (Ally's checking account.